Lower cotton price may hit the spinning units in coming months

Apart from this, the price of yarn has also witnessed an increase of about Rs 20 kg in the last couple of months. -

Apart from this, the price of yarn has also witnessed an increase of about Rs 20 kg in the last couple of months. -

February 29, 2024 The prevaling lower prices of domestic cotton in comparison to international market may impact the spinning and weaving industry negatively. Industry observers say it may adversely impact spinning and weaving industry which may bear the brunt of lesser availability of raw material and higher cotton prices after a couple of months.

Saurin Parikh, President Spinners Association of Gujarat, said, “Because of the lower cotton prices, the cotton export for CY24 may touch 24-25 lakh bales (356 kg each) compared to 14 lakh bales last season. This higher export can impact the spinning units badly though it may result in some relief for the farmers. While the picture will be clearer after the month of May, the spinning units, already functioning below their total capacity, will have to further cut back on installed production capacity.”

Parikh further said, “Due to various global and domestic challenges, there is a lack of demand for fabric/garments in the global and domestic market. Consequently, low demand for yarn from China and Bangladesh means that the yarn prices may not appreciate in correlation with the cotton prices in the near future. The amount of cotton held by the Cotton Association of India (CAI) and other industry players also indicates a tight balance sheet. Furthermore, the stricter enforcement of the 45-day MSME (micro, small, and medium enterprises) payment rule is forcing the industry players to be more cautious while accepting orders.” The rule mandates that large companies must clear payments to MSMEs within 45 days of receiving goods or services, or within 15 days if no written agreement exists.

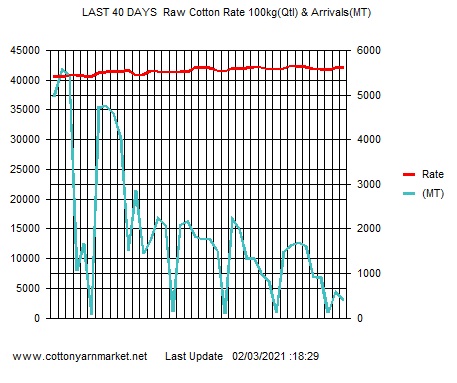

The profitability of spinning units depends on the cotton prices which have already started fluctuating. Within the month of February, the cotton prices have reached above Rs 58,000 per candy (356 kg each) from Rs 55,000 per candy in the beginning of this month. Apart from this, the price of yarn has also witnessed an increase of about Rs 20 kg in the last couple of months.

Balkrishan Sharma, Business Head & Chief Executive, Yarn Business, RSWM Limited, a leading textile player, said, “The lower cotton prices and higher cotton export from India may be beneficial for some of the stakeholders but the spinning units may face grave challenges due to the lower availability for the domestic spinning units to work with. For the spinning units to be functional optimally, it is necessary that the global demand picks up so that the price change in cotton due to higher exports may be absorbed by the garments and the yarn price can go up accordingly.”

He further said, “Various domestic and international challenges like lack of market demand, supply dynamics ( every major cotton player except for Brazil have less quantity of cotton for CY24) and external factors (the Red Sea crisis, the geo-political crisis in the Middle East and the war between Russia and Ukraine) are causing concern for the impact they may have on demand in the industry in the coming months.”

Commenting on the current situation in the industry, Sharma said, “We believe that the worst phase is behind us now. The indicators from the US market, that drive the Indian cotton business, look promising and we are hinging our hopes on that. Inflation rate is picking up, real wages are growing and the consumer sentiment is positive in western markets, although the deteriorating European market is an area of concern. We believe that there will be an improvement in the industry from June onwards.”

Most viewed

- Indian Cotton Exports Soar: Projections Reach 22-25 Lakh Bales for 2023-24 Season

- Godrej Agrovet’s crop protection biz unit launches pilot to reach out to cotton growers

- India’s cotton panel CCPC estimates higher crop, export and consumption

- जिरायती कापसाचे पीक यंदाही तोट्यातच

- Cotton Declined After CCPC Increased Crop Production For The Current Season

- Cotton production report 2024 – कॉटन के उत्पादन अनुमान में 5.30 फीसदी की बढ़ोतरी, 309.70 लाख गांठ की उम्मीद

- यंदाच्या हंगामात 25 लाख क्विंटल कापसाची आवक, कोणत्या बाजार समितीत किती आवक?

- महाराष्ट्र की इस मंडी में 8300 रुपये क्विंटल हुआ कॉटन का दाम, क्या कह रहे हैं किसान

- किसान इस समय पर करें कपास की बिजाई, कृषि विभाग ने दी किसानों को सलाह

- Picking underway for Australian cotton with above average crops expected: Cotton Australia

Short Message Board

Cotton Live Reports

Visiter's Status

Visiter No. 32876671Saying...........

One man plus courage is a majority.

Tweets by cotton_yarn