New Rule of Payment to MSMEs Causes Uncertainty in Textile Markets

... -

... -

January 31, 2024 A new regulation for the assessment year 2024-25 has been enforced by the central government, mandating that purchasers settle payments for goods procured from MSMEs within 45 days of delivery.

Furthermore, all outstanding dues to MSMEs must be cleared before March 31, 2024. Failure to adhere to these timelines will result in the pending payment being treated as income, subject to taxation.

While the government aims to safeguard the Ministry of Micro, Small, and Medium Enterprises (MSMEs), this initiative has introduced uncertainty in the market, leading to the cancellation of orders in Ahmedabad’s textile markets.

The impact is also felt among chemical traders, with some buyers opting to postpone their purchases until after February 16 to ensure that their payment deadlines extend beyond March 31. The textile value chain, accustomed to a credit period of up to 120 days, is particularly affected by this rule.

Gaurang Bhagat, the president of Maskati Cloth Market Mahajan, stated, “We plan to convene a meeting of all associations to address the challenges arising from this regulation. Numerous order cancellations are currently being observed.”

Bharat Chhajer, the former chairman of the Powerloom Development and Export Promotion Council (PDEXCIL), commented, “Although the intention behind the move is to assist MSME units, the immediate response is quite different. In the textile industry, where the standard credit period is 120 days, adhering to a 45-day payment window for MSMEs is challenging and impractical.

Many traders have already cancelled recent orders, and several have refrained from purchasing goods from MSME manufacturers until at least Feb 16, ensuring that their payments fall due in the next financial year. These matters require clarification.”

Karim Lakhani, a chartered accountant, remarked, “New acquisitions have declined since the introduction of the rule. Customers are now turning to larger and medium-sized units. Given that many businesses operate on credit periods of up to 120 days, numerous enterprises have cancelled orders.”

Nilesh Damani, secretary of the Gujarat Dyestuffs Manufacturers’ Association (GDMA), mentioned, “In the chemical industry, the typical credit period is around 60 days, but due to low demand, this period is often extended. With the implementation of the new rule, many buyers are inquiring whether sellers are registered as MSMEs or not.”

Most viewed

- India’s cotton yarn exports to surge by 85-90% in FY2024: ICRA

- Amid weak demand, cotton price surge adds to woes of yarn mills

- Bihar aims to become major player in textile sector through policy support

- State further subsidises power supply to textile industry till 2028

- Bank fraud case: Textile baron Neeraj Saluja sent to 5-day police remand

- BTMA signals minimum wage structure for cotton textile sector within next two weeks

- Centre willing to procure jute and cotton crop if prices fall below MSP : Goyal

- New Rule of Payment to MSMEs Causes Uncertainty in Textile Markets

- Bangladesh Textile Mills Association seeks intervention from Bangladesh Bank for unpaid bills

- ASEAN delegation to visit India on 17 Feb for FTA review

Short Message Board

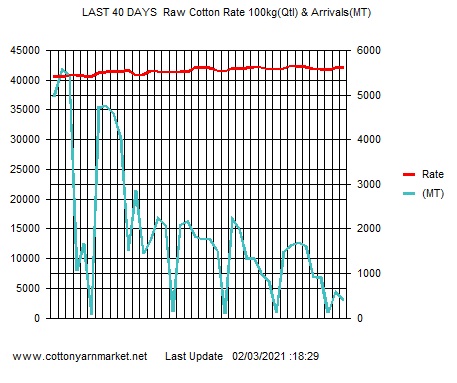

Cotton Live Reports

Visiter's Status

Visiter No. 40976365Saying...........

Tweets by cotton_yarn